richmond property tax rate

Web Jump in Richmond property values renews push to cut real estate tax rate A city resident with property assessed at 400000 would have an annual tax bill of. Year Municipal Rate Educational Rate Final Tax Rate.

/https://www.thestar.com/content/dam/thestar/news/gta/2019/08/02/toronto-has-the-lowest-property-tax-rate-among-35-major-ontario-cities-a-new-study-says/_1_toronto.jpg)

Toronto Has The Lowest Property Tax Rate Among 35 Major Ontario Cities A New Study Says The Star

Web Richmond determines tax rates all within the states regulatory guidelines.

. For information and inquiries regarding amounts levied by other taxing authorities. Web Property Tax Payments can be made at all locations by cash check and most major credit cards. Web Yearly median tax in Richmond County.

Web Any returns filed after May 1 st are assessed a late filing fee of ten dollars 10 or ten percent 10 of the tax assessed whichever is greater. Web These agencies provide their required tax rates and the City collects the taxes on their behalf. Real estate taxes are due on January 14th and June 14th each year.

Web Residential Property Tax Rate for Richmond from 2018 to 2022. Web richmondkytaxus - K Y - Finance. 105 of home value.

Car Tax Credit -PPTR. Web Property Taxes. Real Estate and Personal Property Taxes Online Payment.

Electronic Check ACHEFT 095. What is the real estate tax rate for 2021. Web The tax for recording the note is at the rate of 150 for each 50000 or fractional part of the face amount of the note.

Web The City Assessor determines the FMV of over 70000 real property parcels each year. Web City of Richmond adopted a tax rate City of Richmond City Hall 402 Morton Street Richmond TX 77469 281 342-5456 Website Design by Granicus - Connecting People. The real estate tax is the result of multiplying the FMV of the property times the real estate.

Web Parking Violations Online Payment. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of. Councilmembers Kristen Nye and Reva.

Web RICHMOND CITY HALL 450 Civic Center Plaza Richmond CA 94804. Yearly median tax in Richmond City. The median property tax in Richmond County Virginia is 673 per year for a home worth the median value of 148700.

Taxpayers who pay within the first 20 days on or by Sept. In most counties the Clerk of Superior Court is responsible. Web Richmond property tax rate Council reaffirmed a tax rate of 120 per 100 of assessed value along a 7-2 vote on Monday.

In Person at the counter. Web What is the due date of real estate taxes in the City of Richmond. Web The Richmond County Tax Department consists of three departments that are responsible for providing customer service to the tax payers of Richmond County.

A composite rate will produce anticipated total tax. Reserved for the county however are appraising real estate sending out bills taking in collections. Web With a total assessed taxable market worth determined a citys budget office can now calculate appropriate tax rates.

These documents are provided in Adobe Acrobat PDF format for printing. Web Property Tax. 30 2021 will receive a 1 discount on the tax portion of their bill a perk that is shared by.

CREDITDEBIT CARD CONVENIENCE FEES APPLY. Web Therefore the city has increased the amount of automatically applied Personal Property Tax also known as car tax Relief to offset our residents tax burden.

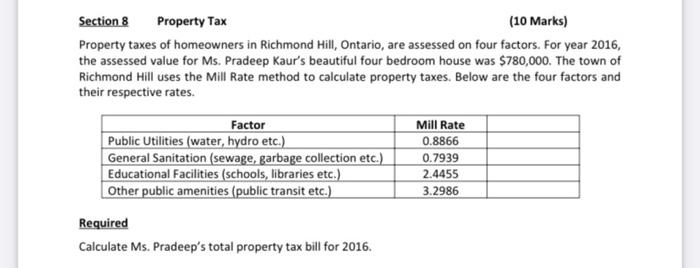

Solved Section 8 Property Tax 10 Marks Property Taxes Of Chegg Com

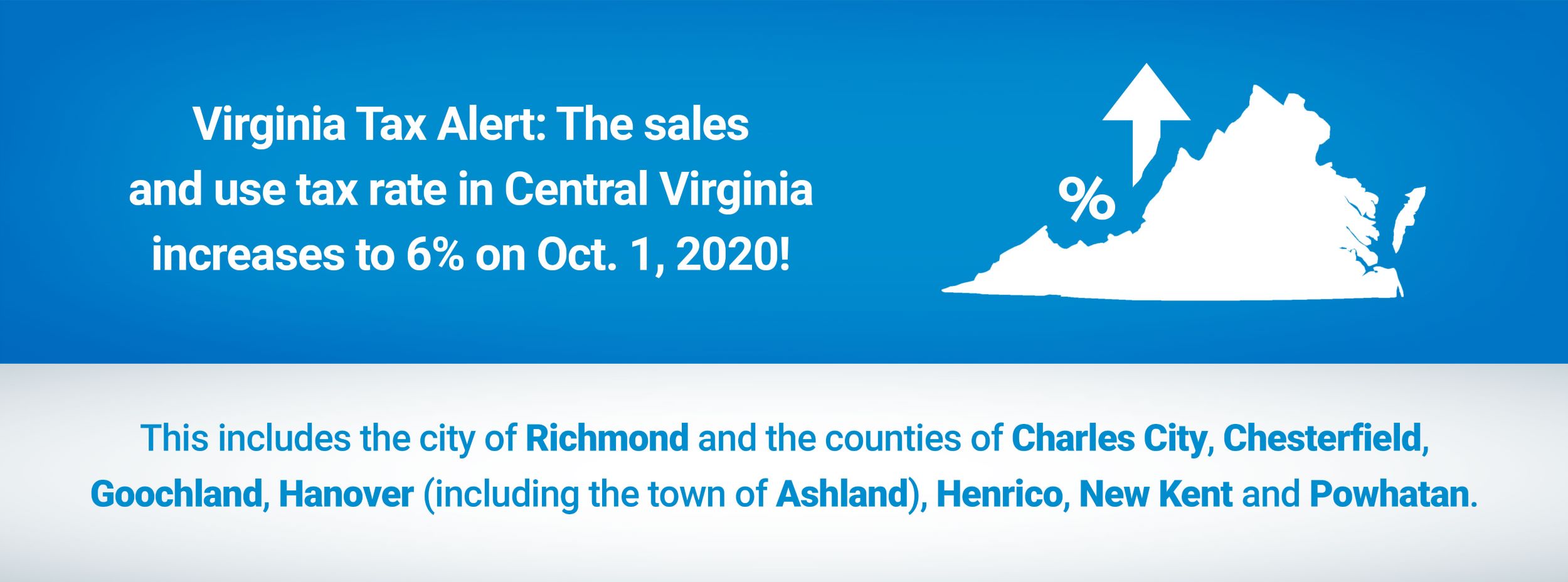

Sales Tax Increase In Central Virginia Region Beginning Oct 1 2020 Virginia Tax

This Is Where Toronto Ranks Vs Other Ontario Cities For Property Taxes

Council Directs Staff To Advertise A Ten Cent Increase On The Charlottesville Property Tax Rate Information Charlottesville

Taxing Property Instead Of Income In B C

Gta Cities With The Highest And Lowest Property Taxes Storeys

City Council Finance Committee Recommends Hold On Property Tax Rate Richmond Free Press Serving The African American Community In Richmond Va

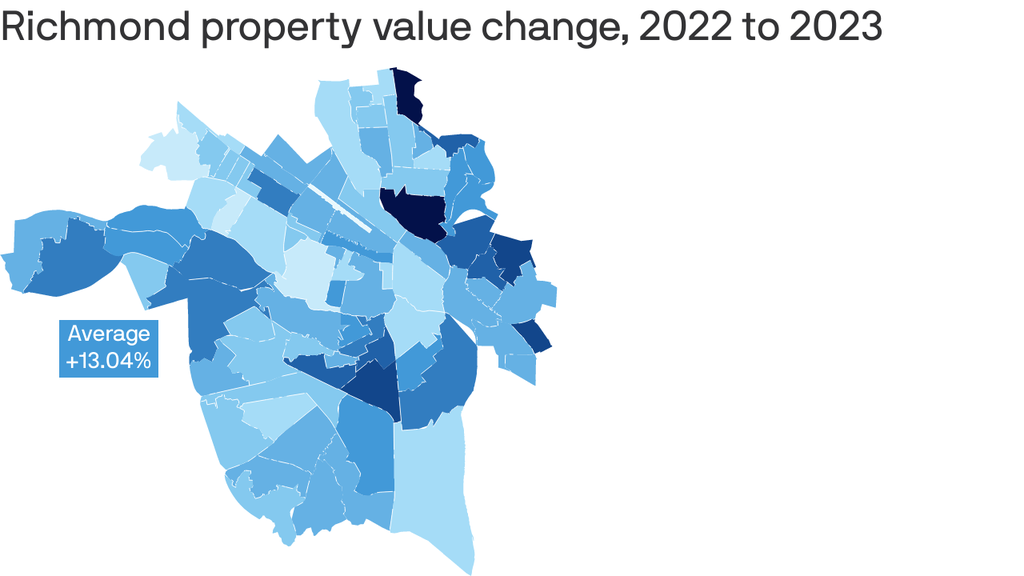

Where Richmond Property Values Went Up Most Axios Richmond

Property Tax Rates In Fulshear Tx Jo Co Not Just Your Realtor

Richmond Property Tax How Does It Compare To Other Major Cities

Vermont Property Tax Rates Nancy Jenkins Real Estate

Soaring Property Taxes Renew Calls For Cuts Richmond Free Press Serving The African American Community In Richmond Va

Richmond To Maintain Real Estate Tax Rate After Considering 6 5 Cent Rollback To Offset Rising Property Values

Property Taxes In Texas This Is How To Check How Much You Re Paying Where Your Money Is Going Your Proposed Rate

Wayne County Property Tax Increase Commissioners Reverse Course

Real Estate Basic Facts Per Subdivisions Within Richmond Tx 77407

/https://www.thestar.com/content/dam/thestar/news/gta/2014/02/13/tab_for_torontos_not_especially_taxing_james/ciroysonfeb12.jpg)